|

Last Month's Economic News

- Employment: Total employment rose by 261,000 in October following September's job reduction. The unemployment rate edged down to 4.1%. The number of unemployed persons declined by 281,000 to 6.5 million. Since January, the unemployment rate has declined by 0.7 percentage point, and the number of unemployed persons has decreased by 1.1 million. The labor participation rate decreased by 0.4 percentage point to 62.7%. The average workweek for all employees remained at 34.4 hours in October. Average hourly earnings fell by $0.02 to $26.53 after rising $0.12 in September. Over the 12 months ended in October, average hourly earnings have risen $0.63, or 2.4%

-

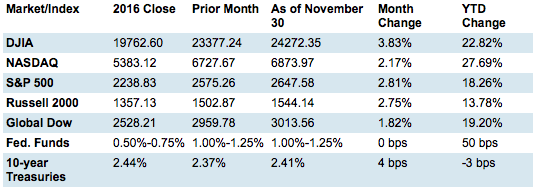

FOMC/interest rates: The Federal Open Market Committee met at the end of October and left the target federal funds rate range at 1.00%-1.25%. However, some economic indicators are showing mild inflationary pressures, which, when coupled with a labor market that could be nearing full employment, may lead to another interest rate hike when the Committee next meets in mid-December. The FOMC may be under new leadership, as President Trump nominated Jerome Powell to succeed Janet Yellen as Fed chairperson.

-

GDP/budget:The second estimate of the third-quarter gross domestic product showed expansion at an annual rate of 3.3%, according to the Bureau of Economic Analysis. The second-quarter GDP grew at an annualized rate of 3.1%. Gross domestic income, which estimates all income earned while producing goods and services, increased 2.5% in the third quarter compared to an increase of 0.9% in the second quarter. As to the government's budget, October marked the beginning of fiscal year 2018. The deficit for October was $63.24 billion ($45.83 billion in October 2016). The federal deficit for FY 2017 was $665.7 billion, more than $80 billion, or 13.7%, higher than the 2016 deficit.

-

The Consumer Price Index, which rose 0.5% in September, edged up only 0.1% in October. For the 12 months ended in October, consumer prices are up 2.0%, a mark that approaches the Fed's 2.0% target for inflation. Core prices, which exclude food and energy, increased 0.2% in October, and are up 1.8% over the prior 12 months.

-

The Producer Price Index showed the prices companies receive for goods and services advanced 0.4% in October, the same increase as in September. Year-over-year, producer prices have increased 2.8%. Prices less food and energy increased 0.4% for the month and are up 2.3% over the past 12 months.

-

Housing: The housing sector continues to gain momentum towards the end of the year. Total existing-home sales climbed 2.0% for October following a 0.7% rise in September. Over the last 12 months, sales of existing homes are down 0.9%. The October median price for existing homes was $247,000 ($245,100 in September), 5.5% higher than the October 2016 median price of $234,100. Inventory for existing homes fell 3.2% for the month, representing a 3.9-month supply. The Census Bureau's latest report reveals sales of new single-family homes climbed 6.2% following September's whopping 18.7% jump. The median sales price of new houses sold in October was $312,800 (September was $319,700). The average sales price was $400,200 in October, up from September's $385,200. The number of houses for sale at the end of October was 282,000 (279,000 in September), which represents a supply of 4.9 months at the current sales rate.

-

Manufacturing:Industrial production increased 0.9% in October following a 0.3% increase in September. Industrial production has risen 2.9% over the past 12 months ended in October. Capacity utilization increased slightly from 76.0% in September to 77.0% in October. Manufacturing output climbed 1.3%. Mining output fell 1.3% in October after rising 0.4% in September. The index for utilities jumped 2.0% after gaining 1.5% in September. New orders for manufactured durable goods fell 1.2% in October following consecutive monthly increases of 2.2% and 1.7%. Shipments of manufactured goods, up 5 of the last 5 months, increased $0.3 billion, or 0.1%, to $241.0 billion.

-

Imports and exports:The advance report on international trade in goods revealed that the trade gap for October was $68.3 billion, up from the $64.14 billion trade gap in September. Exports of goods for October were $129.1 billion, $1.0 billion less than September exports. Imports of goods for October were $197.4 billion, $1.5 billion more than September imports.

-

International markets:In a sign that the European economy is heading in the right direction, the Bank of England raised its benchmark interest rate by 25 basis points in early November. Germany, Italy, and Finland saw their third-quarter GDPs expand at a rate exceeding expectations, while economic growth slowed in France, Spain, and the Netherlands. Japan's GDP expanded at an annualized rate of 1.4% in the third quarter, largely driven by exports, which increased an annualized 6.0%.

- Consumer sentiment:Consumer confidence, as measured by The Conference Board Consumer Confidence Index®, increased in November to 129.5, up from 126.2 in October. According to the report, consumer confidence in the economy increased for the fifth consecutive month and remains at a 17-year high.

|